|

The Dark Bid Wage-Adjusted Unemployment Rate is 24%

Daniel Drew, 1/9/2015 On the first Friday of the month, the Bureau of Labor Statistics releases the monthly unemployment rate data at 8:30 - or 8:29 for select high frequency trader participants. The BLS has become one of the largest punching bags in the financial industry because of their generally useless official unemployment rate. They have even tried to deflect some criticism by publishing a separate report called "Alternative Measures of Labor Underutilization," which is the economist way of telling you you're screwed. According to the more accurate data in this report, the unemployment rate is actually 11.4%, which is a lot higher than the official rate of 5.8%. It just shows there is no single way to calculate unemployment. Not all jobs are created equal, but the unemployment rate does not acknowledge that fact. I calculated the unemployment rate using a new proprietary method. Tweet Chaos in Corporate America: New Accounting Rules to Disrupt Every Industry Listed in The Reformed Broker Daniel Drew, 1/1/2015 The goal of every board is to justify its existence. That's what the FASB and IASB are doing right now, and they don't care if it disrupts every industry in America. The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) are the rulers of the accounting departments in every corporation. They decide what is true and fair, and they determine the proper way to report your financial statements. The IASB consists of 14 "experts," and the FASB has 7 members on the board. In the modern world of unprecedented efficiency, most people have taken fake jobs to give themselves a facade of meaning. What better way to assert your importance on the world than to create new revenue recognition rules for the entire country? That's exactly what our 21 accounting masters of the universe have done for us. Tweet The Interview: Hacking American Culture Daniel Drew, 12/20/2014 From George Washington to Steve Jobs, hacking is part of American history. The Interview's downfall is actually the most successful marketing campaign in all of history. Create a movie about assassinating a deranged narcissistic dictator, market the absurdity of that movie, attract the attention of the dictator, incur the wrath of his computer nerd army, have the President endorse the viewing of your movie as a patriotic duty, and then pull it at the last minute because some computer geeks said they would blow up theaters. What started as a standard fringe comedy turned into the fixation of the entire country. Sony, you have our attention. Tweet Huge Rally: S&P; 500 Up 2.50% Daniel Drew, 12/18/2014 Today, the S&P; 500 went up 2.50%, with a full 1% ramp in the final hour thanks to the Fed. How often has this happened historically? If we take a look at the daily changes in the S&P; 500 since December 2008, we'll see that the market has gained 2% to 3% 42 times, or 3.25% of the time. The odds of getting 3 of a kind in poker are 2.11%. These are low odds, but it's not entirely inconceivable for the market to go up 2% or for a poker player to get 3 of a kind. Anything beyond 3% or 4% in the S&P; 500 is truly historic. Also, this is just a recent study. It does not include the wild volatility of the 2008 crash. So it doesn't make sense to get too excited about a 2.50% day in the market even though it was the best day since January 2, 2013. However, what is noteworthy is that yesterday was also a large day. In the past 2 days, the S&P; 500 is up 4.50%. Tweet Wealthfront: A Front for Mediocrity Daniel Drew, 12/16/2014 Wealthfront is like that old ugly sweater your mom keeps wrapping up every Christmas and giving to you as a joke - except this joke isn't $19.99. It's $1 billion and counting. Andy Rachleff started Wealthfront in 2008 - a great year to start an investment advisory service. Wealthfront is a Palo Alto-based millennial reincarnation of the old index investors of the 1970s. It's a Burton Malkiel project that funnels business into Vanguard. For the uninitiated, Malkiel wrote a famous book called A Random Walk Down Wall Street in 1973. The book is nearly 500 pages and has 9 editions to reassure you that it is still valid. The entire book in two sentences: The stock market is a crapshoot anyway, so let's buy everything. They can't all go to zero. And thus, the ideal of mediocrity was born. Tweet Crude Effects: How Crude Oil Affects Airline Stocks Daniel Drew, 12/11/2014 It's a LUV story that begins with warm feelings and ends in heartache. LUV is the ticker for Southwest Airlines, which spearheaded the movement for extreme hedging in the last decade. Here's the problem in its most basic form: Fuel costs can be a defining expense on any airline's income statement. Fuel prices are volatile. Like crazy girlfriends and boyfriends, people don't like volatile things - especially executives whose compensation is in the form of stock options. They want the profits to come in regularly so the stock price can go up smoothly without giving them indigestion. Volatile fuel prices are like the jalapeno your irritating friend hid in your sandwich at lunchtime Tweet |

Fired Before Hired: How Corporations Rigged The Job Market And Killed The American Dream

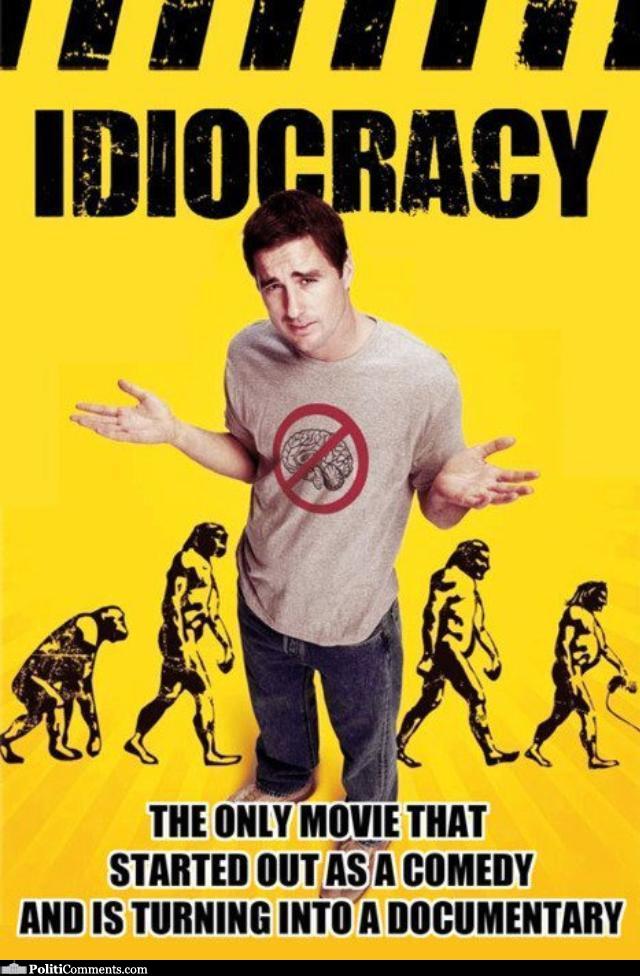

Featured in Zero Hedge Daniel Drew, 1/27/2015 The latest corporate scam is to blame workers for the high unemployment rate. They say there is a skills gap. Even President Obama is in on the joke. In his most recent State of the Union address, Obama called for Congress to make community college free. Because nothing will get you a job more than an associate's degree from your local college. The real skills gap is the other way around: too many skills for the low-wage menial jobs that pervade the labor market. The person who makes your coffee or your Big Mac might be able to design the next major bridge or write for The New York Times. Instead of high school kids cooking up your lunch, true professionals are behind the counter, and the future of the country is behind it too. The longer they stay there, the odds increase that America will take a permanent backseat in global power. In one short century, we have gone from superpower to super size me, a plutocracy, a nation that wasted its most valuable resource: the energy and innovation of its own people. Tweet Art Of The Bluff: Central Banker Edition Daniel Drew, 1/15/2015  Strong means weak. When a poker player is bluffing, sometimes he will overcompensate and act too strongly to make sure his opponent gets the message. As I wondered if we could have foreseen the Swiss National Bank's surprise move to abandon the cap on the franc, I decided to look for clues in the central bank statements prior to the surprise. What I found was repetitive language about defending the exchange rate that seemed suspicious. On December 18, 2014, Thomas Jordan, SNB chairman, said enforcement of the exchange rate was "key" three times. He said they would defend it with the "utmost determination" twice. This is for a statement that was barely over 2 pages. So it wasn't some summary after a long-winded speech. A week earlier, he also said the exchange rate enforcement was "key" two times. The phrase "utmost determination" was there again as well. Tweet Investment Guide for the American Dystopia: Go Long the 1%, Short the Middle Class Featured in Zero Hedge Daniel Drew, 1/11/2015  Would you short the Brady Bunch? I would. Mike Brady is supporting nine people on one salary in a large two story house in an LA suburb. It would have been a difficult feat in 1970 and impossible in 2015. In 2006, he might have been able to pull it off with a subprime mortgage, but eventually, a modern version of Mike Brady would be utterly screwed. The middle class is being wiped out as the 1% take control, aided by a Federal Reserve which supplies them with all the monetary ammunition they need to take over the world. The economy is like a Toyota with a jammed accelerator pedal. It will either collide with reality or the pedal will somehow disengage. Even if it disengages, it will become clear there is no one at the wheel to steer us to safety. As long as the Fed's liquidity pedal is stuck, the 1% party is on. The middle class will continue to be decimated, and the ranks of the retail slaves will swell. The effects show up in the data, and the stock prices of particular companies show clear trends. When our Toyota hits the wall, or the Fed takes away the punch bowl, then all bets are off. The Long/Short Strategy for the New Reality 1. Go long companies that cater to the 1%. Tweet Consumer Nation: Idiocracy Replaces Democracy Daniel Drew, 1/6/2015  "As the 21st century began, human evolution was at a turning point. Natural selection, the process by which the strongest, the smartest, the fastest, reproduced in greater numbers than the rest, a process which had once favored the noblest traits of man, now began to favor different traits. Most science fiction of the day predicted a future that was more civilized and more intelligent. But as time went on, things seemed to be heading in the opposite direction. A dumbing down. How did this happen? Evolution does not necessarily reward intelligence. With no natural predators to thin the herd, it began to simply reward those who reproduced the most, and left the intelligent to become an endangered species."It has never been a pastime of mine to focus on the mental shortcomings of others, but the levels of intellectual decline have reached critical levels. The other day, a popular website known as "BuzzFeed" was brought to my attention. For those of you who are unfamiliar with it (most of you I hope), it is a focal point for the mindless who wish to read groundbreaking articles such as "31 Pictures That Prove 2015 Will Be The Cutest Year of All Time," "16 Reasons Tara Reid Has the Best Vacations," and "This Is What Happens When You Pretend to Be a Bagel on Tinder." Not only is this content not helpful, it actually makes you dumber when you read it. It is an opportunity cost because you could be reading something else. Even worse, some of the material has been conclusively identified as plagiarized. The BuzzFeed editor-in-chief apologized in July 2014 after finding 41 instances of plagiarism - because it's so hard to write about 10 Reasons Why We Love Miley Cyrus without plagiarizing. I became curious just how popular such material actually is. CuteStat is a website that allows you to see how much traffic a website usually gets. The New York Times website has about 10.3 million daily viewers and 83 million daily page views. Now brace yourself: BuzzFeed has 10.9 million daily viewers and 87 million daily page views. More people are interested in visiting BuzzFeed to see cat pictures, Justin Bieber, and all the related pop culture garbage than they are in reading The New York Times, which for the most part, contains in-depth articles about the world's most pressing issues and world class journalism. Tweet |