|

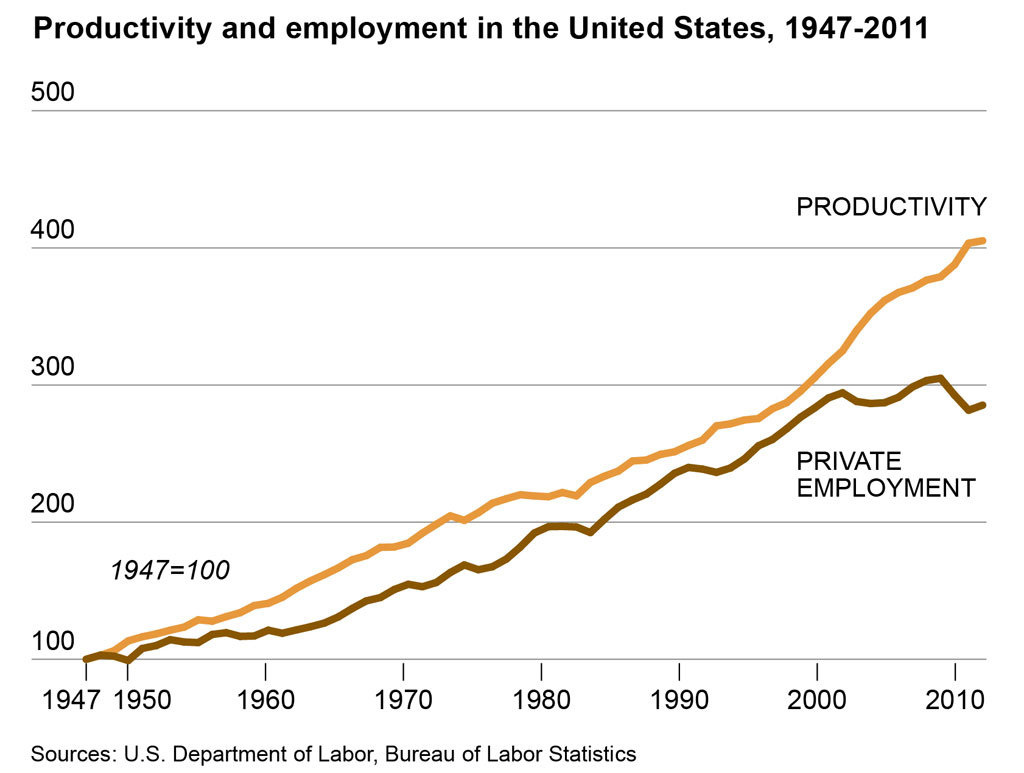

The Economics of Efficiency: Fake Jobs, Fake Growth, and a Two Class Society Featured in Zero Hedge Daniel Drew, 12/4/2014 TweetThe most efficient outcome is the one without human involvement. That is the problem of efficiency. Throughout our entire lives, we have been trained to focus on how to get the most work done in the least amount of time. If we did this, we would feel satisfied. But perhaps we have set ourselves on the path to a meaningless existence. The Luddites experienced efficiency in the early 1800s. They were skilled textile artisans, but stocking frames, spinning frames, and power looms threatened their way of life. What was their response? If this happened today, they would be called left-wing terrorists. The Luddites burned down mills and destroyed the machines that were replacing them. The word "Luddite" allegedly comes from Ned Ludd, a young man who destroyed two stocking looms in 1779. Now, anyone who expresses anti-technological sentiments is called a Luddite in a disparaging way. Most people consider the Luddites to have been mistaken. They should just find other employment. For awhile, this was possible, but in 2000, something changed. Productivity and employment had always risen together, and economists assumed this pattern would continue. They were wrong. In 2000, productivity continued to increase, but employment declined. This divergence accelerated during the 2008 crash. As more people lost their jobs, lost their homes, lost their retirements, got divorced, and postponed starting a family, efficiency increased.

The Luddites are getting closer and closer to a vindication. In October 2011, Erik Brynjolfsson and Andrew McAfee wrote a book called Race Against The Machine that discusses this. Maybe it really is different this time. Maybe the Luddite impulse was the right one. If they were upset about some power looms, just imagine how they would feel about a device the size of your hand that allows you to see a person thousands of miles away.

One of the fundamental parts of the human experience is maintaining a sense of dignity in your work. This comic by Ruben Bolling shows what we have become as a society. It's hard to give an honest explanation to a child when they ask you what you do all day. You would rather not have them know. The disorganized pile of occupations that describes our current state of civilization is not what we told our kindergarten teacher what we wanted to become. No more doctors, astronauts, and businessmen. Now we have content creators, tech start-up P.R. disaster recovery specialists (for Uber, presumably), rage pundits, and one-percent service providers. Why do such ridiculous jobs exist? Efficiency of course. CNN reported: Last year, a team in Oxford University performed a detailed analysis of over 700 occupations in the United States. They came to the conclusion that jobs constituting a staggering 47% of U.S. employment - well over 60 million jobs - could become automated in a decade or two. John Maynard Keynes, the famous economist, wrote a paper called The Economic Possibilities for Our Grandchildren in 1930. He described our modern economy: "The increase of technical efficiency has been taking place faster than we can deal with the problem of labour absorption; the improvement in the standard of life has been a little too quick...the economic problem, the struggle for subsistence, always has been hitherto the primary, most pressing problem of the human race...If the economic problem is solved, mankind will be deprived of its traditional purpose. Yet there is no country and no people, I think, who can look forward to the age of leisure and of abundance without a dread. For we have been trained too long to strive and not to enjoy. It is a fearful problem for the ordinary person, with no special talents, to occupy himself, especially if he no longer has roots in the soil or in custom or in the beloved conventions of a traditional society. To judge from the behaviour and the achievements of the wealthy classes to-day in any quarter of the world, the outlook is very depressing!" The most common way to maintain a sense of purpose in the modern world is to take a fake job, as illustrated by Ruben Bolling. As long as you feel like you are contributing to society, you will maintain a facade of meaning. Stanley Bing, the satirist media executive at CBS, wrote an entire book dedicated to this concept. Appropriately, it's called 100 Bullshit Jobs And How to Get Them. Some jobs featured in the book include chairman, computer game tester, construction site flag waver, life coach, and investment banker. So if efficiency hasn't stopped increasing, but jobs have declined, then where is all the money going? To the stockholders. Not the small time stockholder though. The small time stockholder had to cash out his retirement account at the March 2009 low and pay a 10% early withdrawal fee just to pay his bills after losing his house, his job, and maybe his family too. The big stockholders, with millions and possibly billions in reserves, had the opportunity to double down on their stocks - in the companies they controlled. But even they had their problems.

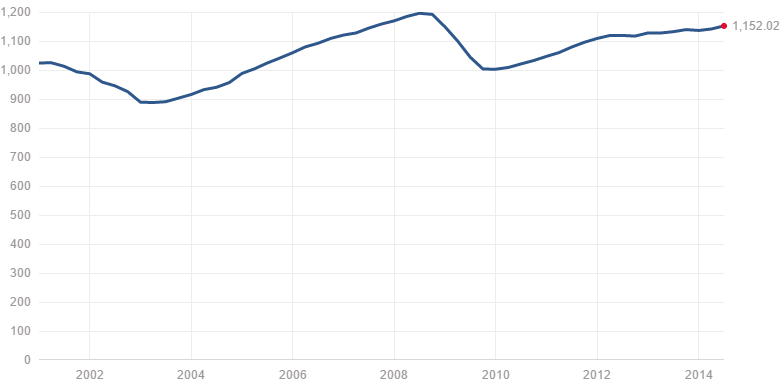

If people don't have enough money to pay for goods and services, then a society will stagnate or decline. It's the "we're in this together" concept that is a hard sell to the individualist inside of everyone. Since the great divergence of efficiency and employment in 2000, people have not had enough money. This reality shows up in the revenue for companies in the S&P; 500. Sales per share have been relatively flat since 2000. But this is also misleading because of the immense stock buyback programs that corporations have initiated. This last year, companies have spent about $900 billion on either buybacks or dividends, which is 95% of their profits. They are not investing in their businesses. They are just giving it to the 1%. From 2003 to 2012, S&P; 500 companies used 54% of their earnings, or $2.4 trillion, to buy back stock. Another 37% of their earnings went to dividends. This left only 9% of profits left for reinvestment in the actual business. The whole concept of a buyback is to inflate the share price so executives can boost the value of their stock option compensation. These financial steroids boost the stock price and the sales per share and reduce the number of shares outstanding. This means the relatively flat sales per share number for the last ten years hides the fact that sales for the 500 largest companies in America have been declining for the last 10 years because the middle class cannot afford to buy what they're producing. Not only do the buybacks increase wealth inequality, they also disguise the pervasive decline of the American economy. But at least it's efficient. |