|

What Happens To Stock Prices After Layoffs

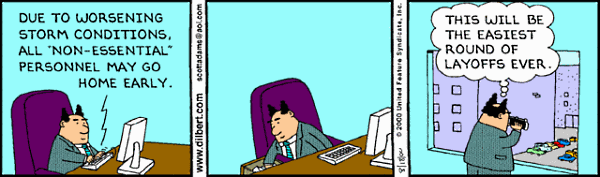

Featured in Zero Hedge Daniel Drew, 6/5/2015 Tweet  Increasing synergies. Downsizing. Staying nimble. Cutting back. Restructuring. What do all these corporate buzzwords have in common? They're all bullshit explanations for why you're about to lose your job after years of commitment to the company. As the market climbs higher and higher, and we approach the ultimate privatization of all capital, it seems like the corporate propaganda is actually true. Maybe layoffs are making companies more efficient, and this creates shareholder value. The foreigners and the robots can replace us, and the shareholders will be better off. A case study of two of the largest conglomerates in America defies the message that the American worker is no longer needed. Consider General Electric and Honeywell. The International Business Times recently published an article called, "At General Electric Company, Workers Struggle To Find Footing As Shareholders Reap Windfalls." GE threatened to close its capacitor plant in upstate New York. They said the only way they would keep the plant open was if the workers agreed to a pay cut from $28 to $11. The United Electrical Workers wouldn't agree to that, so GE closed the plant and moved it to Clearwater, Florida. At the new plant, there is no union, and GE can pay their employees low wages. Meanwhile, GE buys back billions of dollars of its own stock, and CEO Jeff Immelt makes millions. Adam Hartung of Forbes called GE a case of "total leadership failure." Ironically, Immelt is on the board of directors at The Robin Hood Foundation. Because nothing says "Robin Hood" like underpaying your employees and keeping the money for yourself. He is also the Chairman of The President's Council on Jobs and Competitiveness. Immelt knows all about jobs and how to get rid of them. GE has eliminated 16,000 positions in the United States since 2008. At Honeywell, things are different. CEO David Cote wrote an article in the Harvard Business Review about his company's "no layoff policy." Instead of laying people off during the 2008 crash, they furloughed their employees to spread the pain around equally. This actually used to be standard corporate policy. Peter Cappelli, author of "Why Good People Can't Get Jobs," said, Until 1985 the U.S. Bureau of Labor Statistics didn't even have a category for permanent job loss. Until then the assumption was that if a company laid you off, it would rehire you when the economy picked up. That changed during the 1981-1982 recession.By avoiding layoffs, companies can sidestep the cost of constant turnover. The whole process of hiring and firing is much more expensive than one would think. Less churn is better for everyone. A look at the 10-year stock performance of GE and HON is evidence of this. General Electric lost 21%, and Honeywell gained 164%. For Cote, it's personal: He used to work at GE until Jack Welch, the former CEO, told him he would not be his successor. Now, with fair labor policies and an outperforming stock price, Cote has the last laugh. However, just when you start to trust a corporation, this happens: |