|

Hedge Funds Make Billions Front Running Buy-And-Hold Investors Every Year

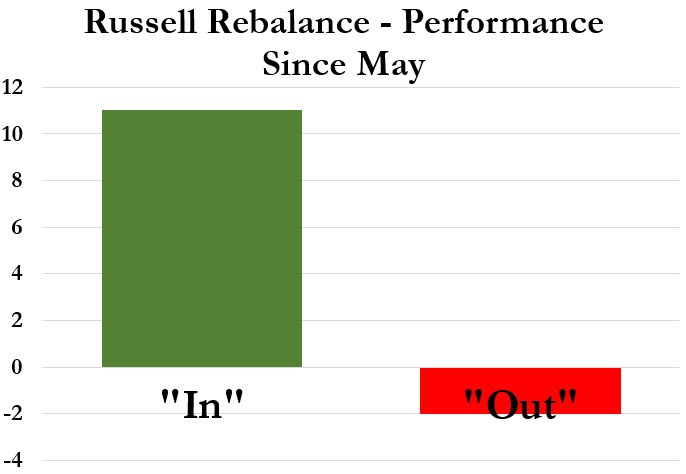

Daniel Drew, 7/7/2015 Tweet Hedge fund managers want you to believe they're rich because they're producers and innovators. The reality is they simply play by different rules. In this case, they are making billions front running the stock indices that financial advisers told their mom-and-pop investors were Wall Street's safest investments. John Bogle of Vanguard turned index investing into a religion. The whole idea of this approach is to avoid blunders by buying and holding a basket of stocks. However, this strategy is anything but passive because a committee has to make index rules, and companies are added and removed at various points in time. Make no mistake: someone is at the helm "managing" the index and executing the plan. There is no such thing as passive investing. While portfolio turnover levels vary, all investing is an active endeavor. This also means that other investors are actively trying to outsmart you in the market. Another goal of index investing is transparency, which is an admirable ideal but is terribly misguided in this situation. Indices have transformed from mere guidelines to precise benchmarks. Rather than looking to the index for guidance, many index fund managers are copying it mechanically and still getting paid despite doing no thinking at all. The assets benchmarked to the S&P; 500 exceeded $2 trillion last year. That's $2 trillion of dumb money just waiting to be front run by Wall Street. Front running is one of the easiest ways to make money. It's essentially insider trading, except the inside information isn't about corporate activity; the information is about client order flow. In this case, since the index investors are not their clients, it is legal for hedge funds and any independent traders to front run them. One could argue that the hedge fund managers are doing nothing wrong; it's the investors' fault for acting irresponsibly. The problem with that argument is that many of these investors don't have a clue about what is happening to them. They are trusting their financial advisers and investment managers to act in their best interests, but as Matthew McConaughey's character in The Wolf of Wall Street explained, the name of the game is to "move the money from your clients' pocket into your pocket." One of my favorite parts of the investment industry is how fees aren't your only expenses. Typically, a fee is a payment you make to a third party for services rendered. On Wall Street, you may never have to actually write a check to anyone. All the expenses are merely deducted from your account and are usually documented in some obscure footnote in small writing. If you actually read that document, you would encounter words like expense ratio. Doesn't sound as bad as a fee. It's just a harmless ratio. By turning dollars into ratios, the investment industry shifts the focus from concrete fees to abstract math. Other words may never be mentioned - words like "market impact," which is the price slippage that affects a portfolio as more trading takes place. Index funds have taken market impact to a whole new level. By mechanically following their benchmark index and not using any discretion, index fund managers are giving the green light to hedge funds to front run them. They don't care about this because they get paid even if their clients get front run. While you will never see a "Front Running Expense Ratio" in your fund prospectus, one researcher decided to analyze what that ratio would be. Christophe Bernard, PhD Senior Scientist at Winton Capital Management, estimates that front running costs index investors 0.20% per year. That's 4 times the official expense ratio of Vanguard's S&P; 500 ETF. Based on the large amount of assets tracking the S&P; 500, index front running costs buy-and-hold investors billions every year. Front running doesn't stop with the S&P; 500. The Russell indices are rebalanced in June, and they are front run every year. As Zero Hedge noted, the additions to the index gained 11% between the announcement date and the add date, which is money that comes out of the pockets of mom-and-pop investors.  You get what you pay for in life. Like going to a cheap mechanic who makes your car worse off than before, going to a cheap index provider may cost you. |