|

Breaking The System: How Two Whistleblowers Exposed Corruption At The SEC And Took Down The Largest Hedge Fund In The World

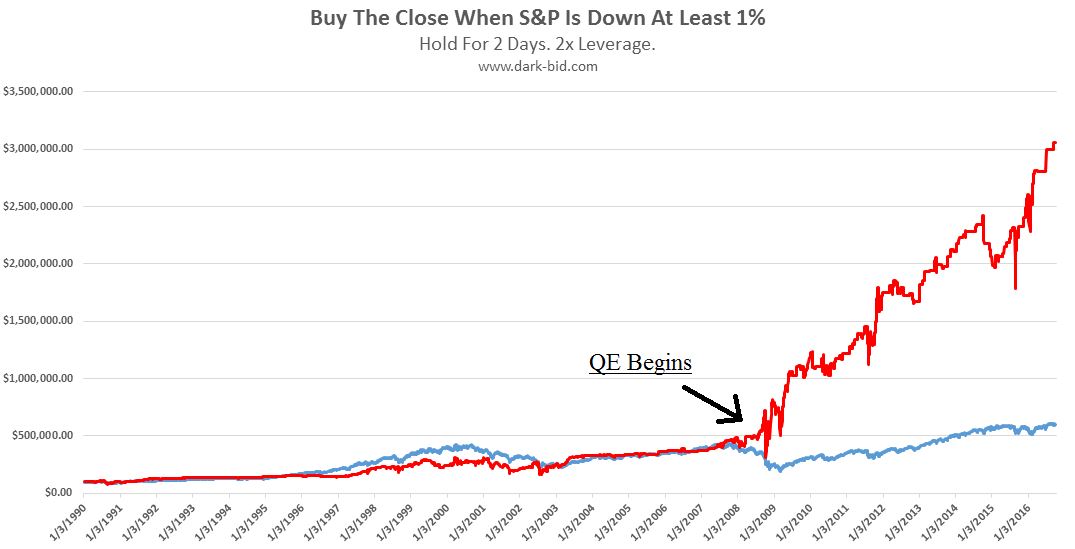

Daniel Drew, 9/23/2018  Gary Aguirre looked down at the paper beneath his glasses, his eyes slowly moving side to side. He was on summer vacation, and he wasn't sure why the SEC was contacting him while he was out of the office. Then he read the subject line: "Notice of Termination." He started reading more quickly, his eyes dancing back and forth with incredulity. The phrases seemed to jump off the paper, "Terminated.....inability to work effectively with other staff members.....unwillingness to operate within SEC process.....your conduct was inappropriate.....ignored the chain of command.....this decision represents the consensus....." Aguirre was fired. He slammed the paper on the table, and his wife walked in to see what was wrong. How could they do this? How could they get away with it? How could he stop them? Was this how it would end? Tweet Index Investing Unmasked: 96% Of Stocks Are Garbage Featured in Zero Hedge Daniel Drew, 2/25/2017 Index investing means buying a box of garbage stocks sprinkled with a few hope and glamour stocks whose price gains are solely a result of underperforming fund managers grasping for quarterly bonuses and retail investors juicing up their portfolios in a doomed attempt to catch up on their retirement targets. While mom and pop buy a Vanguard index with their $500,000 and get front run all day by proprietary traders, the capitalist televangelist Warren Buffett will continue to actively trade billions while preaching the miracle of buy and hold investing. Tweet The Entire 2008 Crash Could Have Been Avoided With One Simple Trading Rule Featured in Zero Hedge Daniel Drew, 10/11/2016 There is a stark difference between BTFD and trying to save the world. While BTFD can be a valid strategy within shorter time frames, it's not appropriate when the market closes down 3% or more for the week. Tweet BTFD! One Chart Shows Why This Is The Only Strategy That Matters Featured in Zero Hedge Daniel Drew, 10/9/2016  We've all been told to BTFD. Now, we finally have a chart to remind us why this is truly the only strategy that matters in these "markets." Tweet Average ROI in Corporate America Has Collapsed By 80% Over Last 40 Years Featured in Zero Hedge Daniel Drew, 2/8/2016 American corporations have been playing a musical chairs game where the loser gets taken out back and shot. During the last 40 years, the life expectancy of firms in the Fortune 500 has declined from 75 years to less than 15 years. In what Forbes called "the most important business study ever," Deloitte released The Shift Index, which compiles the ROI of 20,000 US firms from 1965-2009. The chart shows an 80% collapse in the average ROI of American businesses. Tweet Fed Scrambles as Oil ETN Premium Soars to New Highs Featured in Zero Hedge Daniel Drew, 1/17/2016 Amidst the market chaos on Friday, a trader brought something strange to my attention. He asked me exactly what the hell was going on with this ETN he was watching. I took a closer look and was baffled. It took me awhile to put the pieces together. Then when I saw the story about mark-to-market being suspended, it all made sense. With the oil fallout quickly spreading, the Fed is resorting to behind-the-scenes manipulation of energy debt, and now, that apparently includes oil ETNs as well. Tweet Janet Yellen Can't Pop The Biotech Bubble, But The SF Gate Can Featured in Zero Hedge Daniel Drew, 7/28/2015 Biotech has a special place in the heart of the gambler investor. In the modern market where the average investor doesn't stand a chance, some of them indulge their hope and turn to lottery tickets. If only they can get the next Gilead or the next Amgen, they will become the next wildly successful "maverick" investor. More lottery tickets seem to be flying around than usual lately, floating alongside the recent biotech bubble. Some have doubted if this is a bubble. Maybe it's different this time. The SF Gate pondered this exact same question 15 years ago, and the market promptly replied. Tweet |

The Big Short 2.0: BlackRock's Consumer Asset-Backed Securities ETF

Featured in Zero Hedge Daniel Drew, 5/23/2017 From the collateralized debt obligations of 2008 to present day ETFs that track anthropology student loans, we have come full circle. In 2008, it was Lehman that blew up. In 2017, the toxic securities won't be confined to an investment bank. They will be inside the portfolios of all the passive indexers, coaxed on by the likes of Warren Buffett, reminding them that indexing is the key to a prosperous future, despite the fact that 96% of stocks lose. Tweet Yield Chasers Left Behind As Treasuries Beat Both Investment Grade and Junk Bonds Daniel Drew, 3/26/2017  The "highest yielding" asset had the lowest return, and the least risky asset had the highest return. This represents the complete implosion of a core principle in modern finance. So the next time you buy a stock that tanked 20% because "it has a good dividend," consider another high yield alternative: Nigerian bonds transacted over Moneygram. Tweet Buying The Rumor is 300% More Profitable Than Buying The News Featured in Zero Hedge Daniel Drew, 3/9/2017 In financial markets, hope is more profitable than reality. Tweet The Difference Between "F*** You Money" and "F*** Everybody Money" Featured in Zero Hedge Daniel Drew, 2/14/2017  Something strange happened at Google recently. Bloomberg alleges that Google paid its top level employees so much that they crossed the line into "F*** You Money" territory, prompting the employees to pack up and quit. While this intriguing turn of events may have transpired at Google and other technology companies, this would never happen on Wall Street for one reason alone: "F*** You Money" is simply not good enough for the fast money crowd. The pinnacle achievement in the investment industry is "F*** Everybody Money." Tweet How To Avoid Being A Retail Bag Holder Featured in Zero Hedge Daniel Drew, 10/10/2016 One chart shows exactly why weekly price performance matters. This is what happened to anyone who only bought after the market was up for the week. Tweet The Indexing End Game: The Wilshire 5000 Only Has 3,607 Stocks Featured in Zero Hedge Daniel Drew, 8/7/2016 What started with good intentions ended with embarrassment as American economic dynamism collapsed in a cascade of falling profit margins, financial engineering, labor devaluation, and lopsided "free trade" agreements. Tweet Barclays Rigged Its OIL ETN By Limiting New Creation Units Featured in Zero Hedge Daniel Drew, 1/21/2016 On Sunday, we warned readers that the iPath OIL ETN was trading at a 36% premium to its fair value. Today, we witnessed the brutal consequences of a two-class market where institutional traders steamroll the clueless retail investor. The OIL ETN plummeted by 17%, representing a loss of $126 million. Today's trading volume was 36.6 million vs average volume of 3.8 million, as institutional selling absolutely crushed retail investors. Tweet Backwards Capitalism: Unprofitable Companies Outperforming For Last 15 Years Featured in Zero Hedge Daniel Drew, 10/12/2015 Perhaps we've been doing it wrong all these years. Capitalism isn't about making money. It's about who can blow through money the fastest. When it comes to increasing shareholder value, there is, quite simply, no better way to do it. Tweet |